how to claim working from home allowance

Contact Us If you have a question about this topic you can contact the Citizens Information Phone Service on 0818 07 4000 Monday to Friday 9am to 8pm. This includes if you have to.

Umbrella Company Allowable Expenses What You Can Claim Dns Accountants Umbrella Company Company Umbrella

Employers can pay you 6 a week extra tax-free.

. Pay As You Earn PAYE Pay Related Social Insurance PRSI Universal Social Charge USC. A link to the online portal can be found here. There are two ways to do this. On the employment page you are saying yes to Do you wish to claim any employment expenses or Capital Allowances after the page for P11D.

You will see a page titled Employment expenses for x you enter the figure on the other expenses box. You dont need any supporting documents for this method nor do you need a signed T2200. Heres how to work out how much you can claim. Once their application has been approved the online portal will adjust their tax code for the 2021.

Fill in the form Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day. You must meet the eligibility criteria - Temporary flat rate method to claim your home office expenses. Expenses you pay because youre working from home cannot be claimed against your income. Claim the amount on line 22900 of your tax return.

If you do then simply make a claim on your 202021 tax return. If not registered for self-assessment then an employee can use the form P87 procedure to claim this allowance. Schedule of home office expenses. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week.

Good news if youve been working from home for the past year. Everyone else needs to make a claim to HMRC by post telephone or via the new P87 micro-service HMRC launched on 1 October 2020. You need to do this to process the receipts and bills you entered on the Receipts Tracker in myAccount. If youre self-employed you may be able to claim some of these expenses.

Applying for relief If you are claiming Remote Working Relief you will need to complete an Income Tax Return. Those who do not submit a self-assessment tax return should simply make a claim to HMRC by post telephone or via the new P87 micro-service HMRC launched on October 1 2020. When you complete your Self Assessment form youll be able to automatically claim for the entire year in the same way as employees on PAYE can via the microservice. This amount will be your claim for 2020 up to a maximum of 400 per individual.

If you are on the page for P11D there should be a page after this for claiming expenses. HRA received can be claimed as an exemption only if the rental expense has actually been incurred by the employee on. Claim for your home office if you started working from home at the end of March and worked there for at least 6 months till the. However you can claim the allowance on your Self Assessment form its section 20 on the full return and section 25 on the short form.

Types of individual expenses. Make sure you claim these expenses. If you share your bills with someone else the cost is divided between you based on the amount paid by each person see Example 2 below. Yet apportioning extra costs such as heating and electricity is tough.

If you are self-employed your first option for claiming for working from home is to claim a flat-rate amount based on the number of hours you spend working as an allowable business expense. If youre one of the many self-employed people in the UK who carries out work from their own home theres some good news for you. Claims above 2500 will mean registering for self-assessment. Letter from employer stating that taxpayer can work from home dates worked at home reason for doing so and whether or not an office is provided at employers premises.

As I complete a self assessment for property I own it states it must be done through this however cannot see anywhere or the form to add this. To claim for the working from home tax relief. If your employer does not pay you a working from home allowance for your expenses you can make a claim for tax relief at the end of the year. Claim 2 for each day that you worked at home during that period plus any other days you worked at home in 2020 due to COVID-19 up to a maximum of 400.

They do not apply when you bring work home outside of normal working hours. Those employees who incur extra household costs due to working from home regularly for either part or all of the week can claim the working from home allowance for. I have been working from home since 5 March and cannot find how to claim the allowance on my tax return. Youre entitled to include part of the running costs of your home in your accounts which will save you some tax.

You can claim a tax deduction if you worked from home for more than half of your total working hours or for more than six months during the tax year that started in March 2020. You will get money back from the taxes you paid. This payment is to cover expenses incurred such as heating and electricity costs. Calculation showing how this amount was arrived at and the apportionment.

This short video will explain how to upload receipts. The allowance is to cover tax-deductible additional costs that employees who are required to work from home have incurred such as heating and lighting the workroom and business telephone calls. An employee in receipt of House Rent Allowance HRA is ineligible to claim tax exemption for such HRA if heshe owns the residential accommodation occupied by himher or has not actually incurred any rental expenditure ie. Employees can claim the working from home allowance for tax year 2021-22.

Self-employed If you only earn income thats already taxed like salary wages or investment income then there are a few individual expenses you can claim. Home expenses You can make a payment of 320 per workday to an eWorking employee without deducting. To claim the tax relief you must have and declare that you have had specific extra costs due to working from home. No more than 2500 of expenses can be claimed using form P87.

Click here for letter template. You need your Government Gateway ID if you dont have one you can create one during the process State the date you started working from home once. To claim for tax relief for working from home employees can apply directly via GOVUK for free. Practical information on how employees working from home during the COVID-19 emergency period can claim tax relief on home expenses.

Employees can claim a fixed amount of 4 per week up to 5 April 2020 then 6 per week thereafter. The HMRC online portal is incredibly simple to use and you can make your claim in a few minutes. Due to that there is essentially a flat rate of 6 a week available to you. Detailed method To be able to use this method.

The way you claim the working from home allowance will depend upon if you submit a self-assessment tax return.

How To Claim The Working From Home Tax Relief Times Money Mentor

How To Claim The Use Of Home As Office Allowance Goselfemployed Co Small Business Tax Deductions Small Business Tax Home Office Expenses

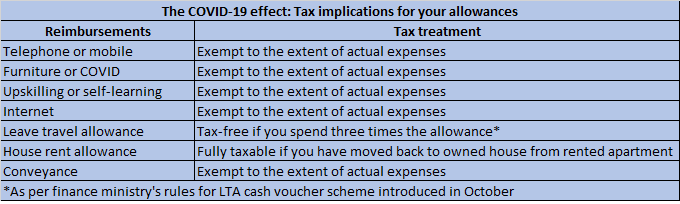

Work From Home Here Is How Reimbursements And Allowances Will Be Taxed

Posting Komentar untuk "how to claim working from home allowance"